Buy-Now, Pay Later (BNPL) Data Is Coming to Your Members’ Credit Scores

Recently1 FICO announced it will introduce BNPL data to credit scores this Fall. This announcement raises concerns about cashflow risk for members, especially for younger and lower-credit score members who might already be living paycheck to paycheck.

Increasing Savings Rate: Positive Impact on Retirement Wealth

While less visible than the Big 3 credit bureaus – Equifax, Experian, and Transunion, which collect and store consumer finance data on all of us, FICO is arguably more important. FICO is a predictive analytics and data science company2. Among other services, FICO provides credit scoring algorithms used by the Big 3 and by lenders of all sizes.

What is BNPL?

Unlike with credit cards, the financing costs for BNPL are born by the seller, not the purchaser. In effect, BNPL allows sellers to reach consumers who might otherwise not make the purchase.

Until now, BNPL data have remained in silos. While card issuers can view a consumer’s other cards and balances, most lenders never see the consumer’s BNPL transactions with competing platforms.

Who Uses BNPL?

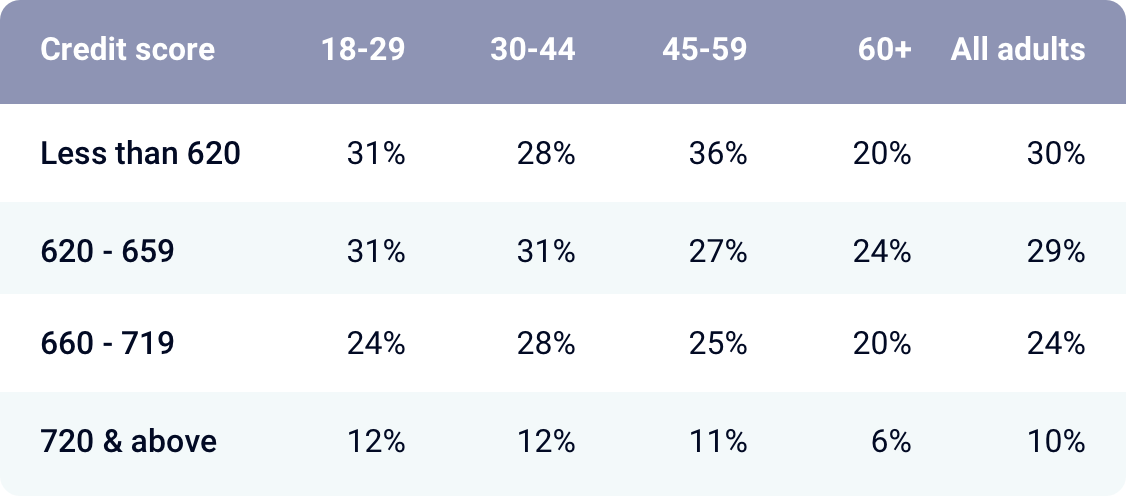

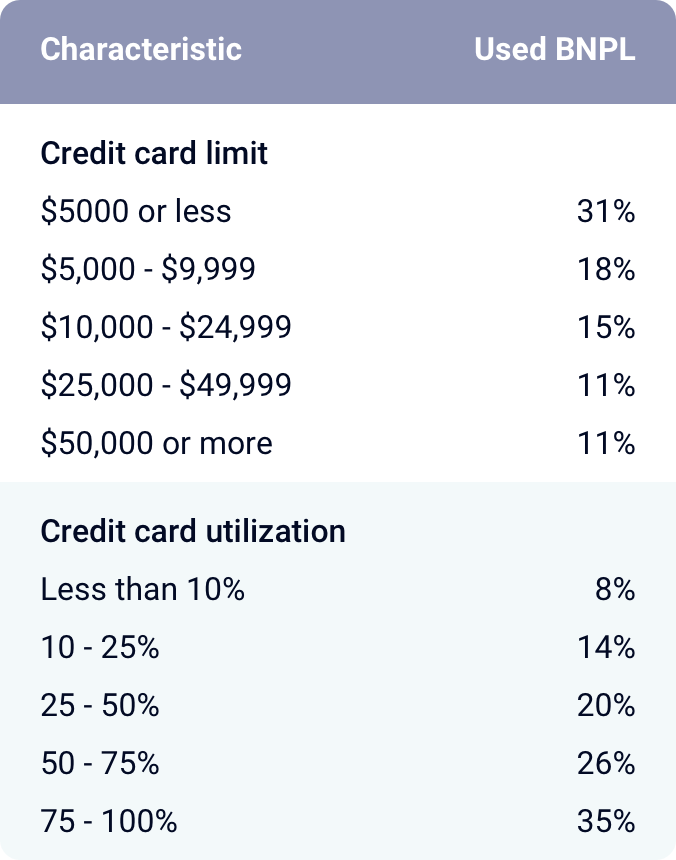

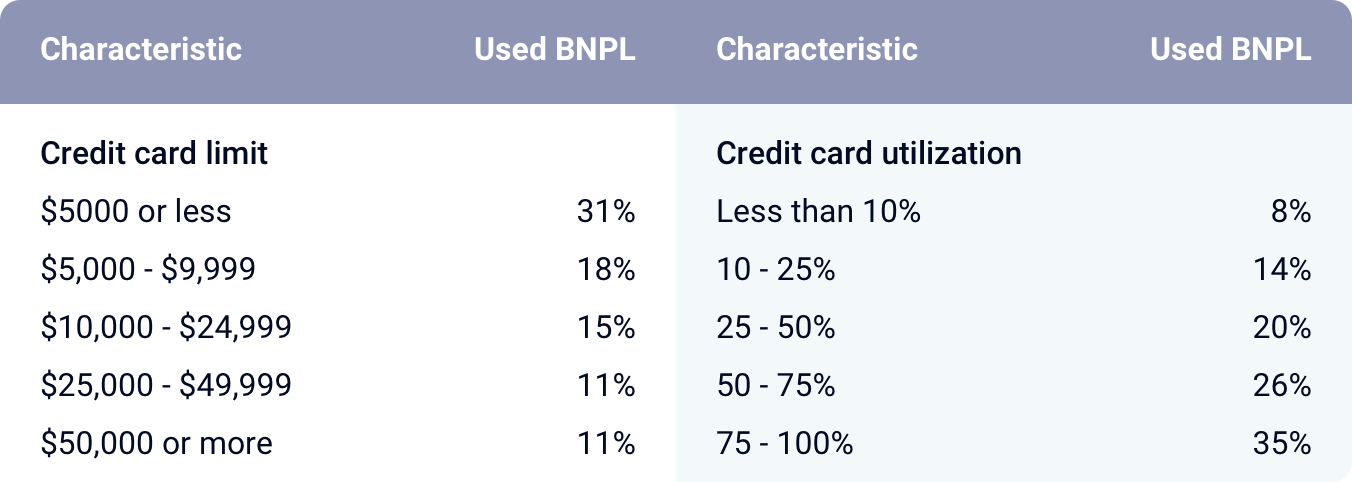

Federal Reserve calculations based on 2023 data5 show BNPL users tend to be young, have low credit scores, and high credit card utilization, as depicted in Tables 1 and 2.

What impact will FICO’s inclusion of BNPL data have on your members’ credit scores?

Plan members who use BNPL and pay on-time might see some of their credit scores improve. Those who do not pay on-time might see some of their scores decline.

FICO supports a variety of score versions.6 The press release mentioned above specifies FICO will evolve its Score 10 and Score 10 T to include BNPL data. If FICO’s earlier versions, especially Score 8 and Score 9, remain widely used, scores calculated by those models should not be affected. It seems reasonable that versions using BNPL data will be used by lenders marketing to Millennials and to higher risk borrowers, possibly to first-time home buyers.

Who benefits and who loses from this decision?

Including BNPL data in credit scores should benefit convenience borrowers who repay on time – higher scores should result in marginally lower interest rates. BNPL data will probably lower scores of consumers who are delinquent, raising interest rates lenders charge them.

Takeaways

Resources

1 FICO Unveils Groundbreaking Credit Scores That Incorporate Buy Now, Pay Later Data, downloaded June 24, 2025 12:17pm PDT

2 https://www.fico.com/en/about-us, downloaded June 24, 2025 4:58pm PDT

3 What is a Buy Now, Pay Later (BNPL) loan?, downloaded June 25, 2025 3:23pm PDT

4 Buy Now Pay Later Statistics (updated June 23, 2025), downloaded June 25, 2025 4:16pm PDT

5 The Only Way I Could Afford It”: Who Uses BNPL and Why, FEDS Notes, December 20, 2024, downloaded June 25, 2025 10:44am PDT

6 https://www.myfico.com/credit-education/credit-scores/fico-score-versions, downloaded June 25, 2025 3:17pm PST